INDUSTRY

Insurance

SERVICES

Designed and built an Azure data platform

Key Takeaways

Company Overview

This customer’s mission is to significantly improve the way life insurance is delivered in Australia today. With fairer, more stable pricing, faster decisions, and a commitment to a new level of customer service. Their aim is to provide value-for-money products and outstanding service, to Australians who want to buy life insurance through a financial adviser.

Mantel Group was engaged by one of Australia’s largest life insurers to help modernise and build out their data platform. The insurance company had several disparate systems owned by external vendors. This presented challenges when it came to integrating these systems and automating business processes. All the data was trapped within a vendor owned system, so gaining any sort of deep business insights was limited to what could be provided by a single vendor.

Mantel Group’s approach was to work closely with the insurance company’s team and start by identifying data related use cases that would help the organisation meet their ambitious growth targets over the next 12 months. The use cases were then prioritised and turned into a roadmap for what the insurer needed from their data estate.

The first use case tackled was the automation of regulatory reporting that currently needed multiple sources of data connected and was being performed as a monthly manual task with a high probability of errors. Unlocking this use case would see an immediate benefit to the business with a relatively short time to value while building out the foundations of a new data platform.

The solution

We want to share the WOW factor of what we delivered but also how we did it…

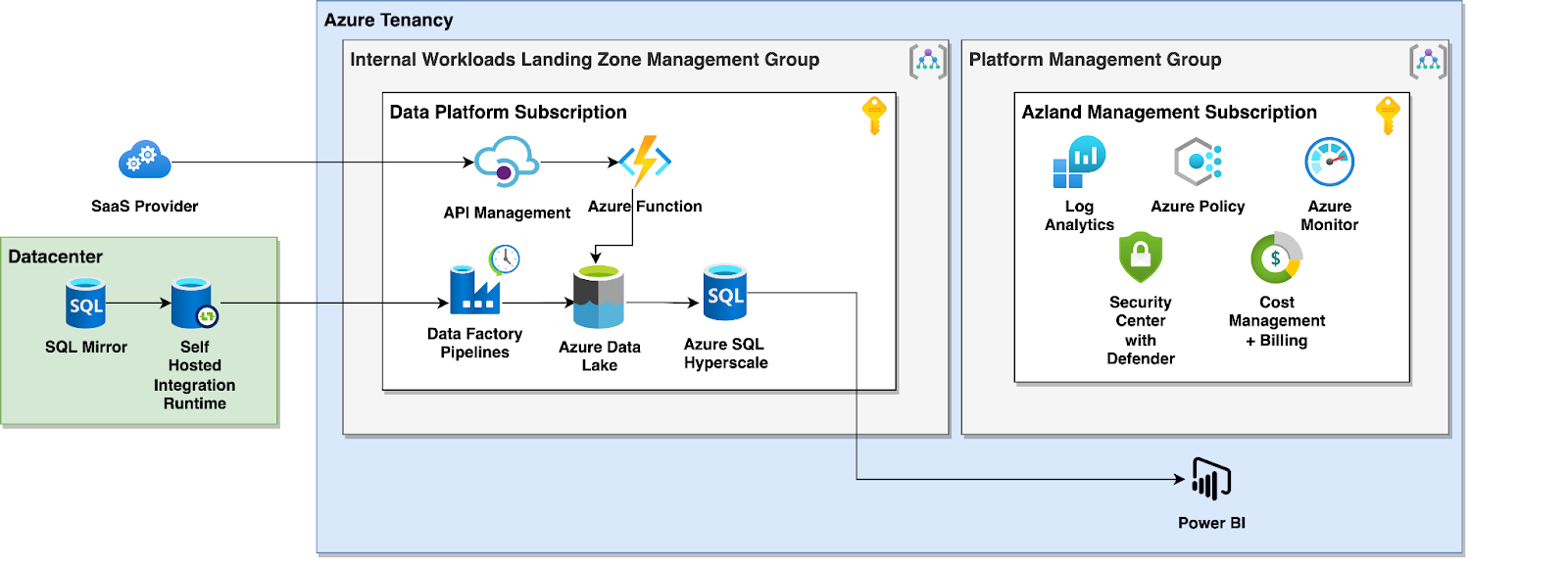

We proposed a solution that uses multiple Azure services to extract data from the wide range of sources needed by the customers analytics team and consolidate into a single source of truth data warehouse. Data is sourced using a combination of Azure Data Factory where out-of-the-box integrations exist and Azure Functions for integrating custom data sources such as ingesting webhooks from a 3rd party Software as a Service (SaaS) provider. All data is landed on Azure Data Lake Storage before being ingested into the Azure SQL based data warehouse.

Underpinning the data platform is a lightweight Microsoft Cloud Adoption Framework (CAF) aligned landing zone. The landing zone ensures critical elements such as monitoring, logging and security have been baked into the solution from day one. Azure Policy was a key feature, providing assurance that the platform was configured to help meet the organisation’s compliant requirements such as NIST.

Why Azure?

When looking to build out the data platform, Azure was the obvious choice. The largest existing system within the organisation stored its data in a Microsoft SQL Server with an additional SQL Server serving as a data warehouse. The insurers team already had expertise in Microsoft’s various data processing tools including SQL Server Integration Services (SSIS) and Power BI for data analysis.

Building on top of Azure allowed Mantel Group to provide a highly scalable, cost-effective modern data platform that could seamlessly integrate with the customers existing data warehouse and leverage the languages and analysis tools the team were already using.

Mantel Group was uniquely placed to help, with deep expertise in all things Azure and data.

The Outcome

The organisation has been able to connect its two most critical sources of data together for the first time. This has allowed for the automation of regulatory reporting which previously required an analyst to export data from multiple source systems and compile the report manually.

They have already realised additional benefits such as feeding data from one system back into another without having to negotiate with multiple vendors to establish an integration.

Now that the foundations are in place, the time to value will be greatly reduced for additional data sources to be added in the future.

Continuing together

After the success of the initial platform deployment, Mantel Group has continued to work with the insurer on the additional use cases identified. Mantel group will also support the platform as it transitions from development to being a core system within the organisation.