Lendi Group launches Australia’s first agentic AI home loan experience, driving a 40% engagement uplift

16 weeks to AI foundation and agentic refinance flow

End-to-end customer experience reimagined

10+ agents deployed using production-ready agent blueprint

40% uplift in customer engagement with the agent

- Data and AI

- Integrated delivery

- Agentic AI framework development

- Software engineering

- AWS

- Databricks

The challenge

The mortgage space has traditionally been a meeting- and document-intensive industry, requiring a lot of back-and-forth in various formats between brokers and applicants.

Lendi Group saw an opportunity to catapult its customer experience into the future, using the power of Agentic AI, placing technology at the core of Lendi Group’s operations and allowing human staff to focus on relationship-heavy and complex cases.

As a part of their public commitment to become ‘AI native’, Lendi Group sought to move beyond a manual, high-friction mortgage application process. This traditional approach resulted in inconsistent customer experiences and frequent drop-offs during the refinance journey.

To address this, Lendi Group needed to establish a capability for building, deploying, and governing AI agents. This foundation was necessary to automate parts of the mortgage process, ensure a consistent experience, and provide a new level of customer service.

Modernising the home loan experience

Mantel’s integrated team partnered with Lendi Group on a 16-week strategic initiative to establish the necessary groundwork for their AI-driven transformation.

Our approach focused on building a scalable, production-ready blueprint for building AI agents on AWS, covering everything from frameworks and memory to observability and guardrails.

This blueprint was concurrently applied to design and build the agentic architecture for automating the home loan refinance process – an improved experience for customers. Lendi Group is also adopting a “compliance by design” approach to address regulatory concerns, embedding audit trails and human override points into all AI workflows – a crucial approach in a wider industry that currently lacks AI guidelines.

The objective of this initiative was to automate the refinance journey by mapping the end-to-end customer and broker journeys and identifying key pain points and opportunities from the initial customer query, “Can I get a better rate?”, through to lender approval.

The objective of this initiative was to automate the refinance journey by mapping the end-to-end customer and broker journeys and identifying key pain points and opportunities from the initial customer query, “Can I get a better rate?”, through to lender approval.

Key tasks included:

- Implementing a new data platform: A new Databricks platform was required to serve as the foundation for this new experience.

- Creating a core framework for agentic AI: This framework was essential for rapid, scalable development of new AI agents on AWS.

- Automating the refinance process: The team needed to build an Agentic AI-powered refinance funnel to automate and accelerate the complex process for customers.

- Designing an intelligent communications engine: This involved creating an Agentic AI-powered system capable of planning and sending personalised, timely communications to guide customers on their mortgage journey.

“Mantel has played a key role in our AI journey. As a thought partner on our agentic architecture, they helped us shape and launch Australia’s first agentic home loan experience with Lendi Guardian, keeping Lendi Group ahead of the market.”

David Hyman

Co-founder, Board Director and Special Advisor at Lendi Group

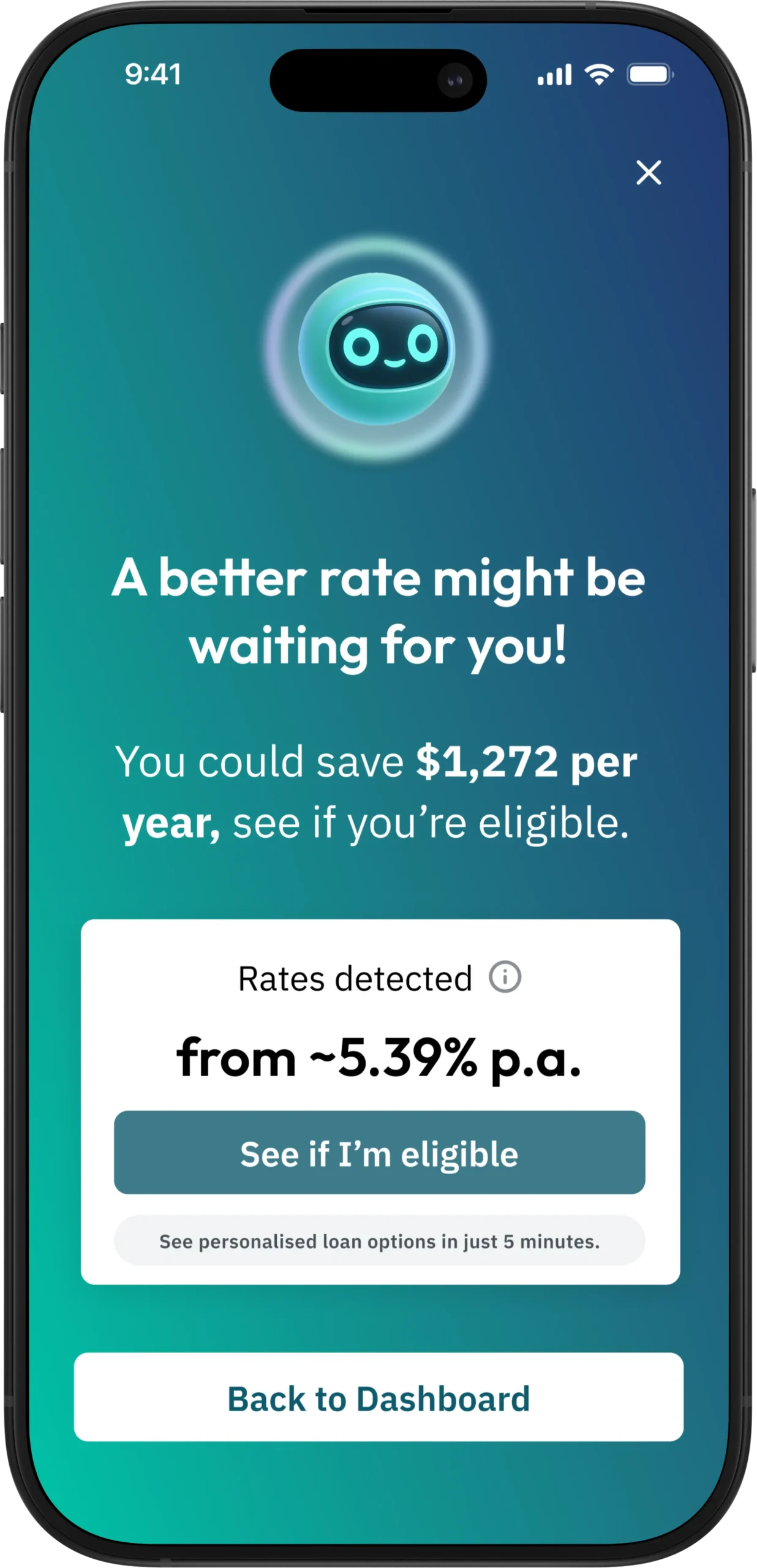

Launching ‘Guardian’, Lendi Group’s proactive mortgage agent

The partnership delivered the production-ready blueprint, enabling Lendi Group to launch their first agentic architecture, ‘Guardian’, which is currently live and available to the public.

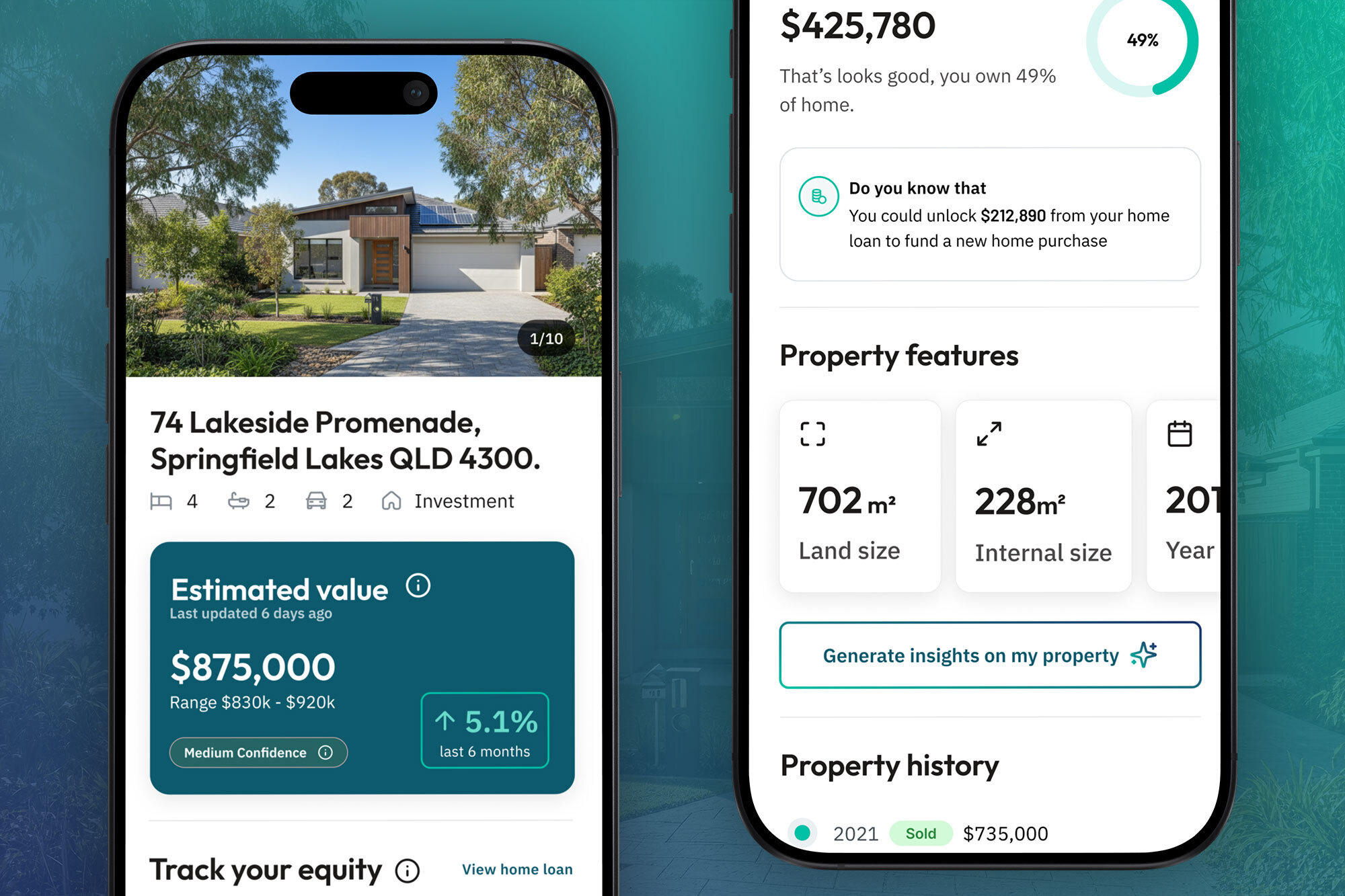

Guardian is an always-on, proactive digital companion. It automates the mortgage refinance application process by proactively monitoring rates and pre-filling forms for the customer. Simultaneously, it reinvents customer communications with personalised, timely interactions throughout the mortgage journey. This delivers unprecedented financial empowerment for Australian homeowners, and puts Lendi’s AI Native vision into practice.

This foundation has established Lendi Group as a leader in the financial services sector and provided quantifiable success. In just 16 weeks, Mantel delivered Lendi Group a production-ready AI foundation and agentic refinance flow. This robust blueprint immediately enabled the deployment of over 10 agents, completely transforming the customer experience and driving a 40% uplift in platform engagement.

The successful launch of Guardian marks a significant step toward Lendi Group’s vision of becoming an AI native business. By establishing a robust agentic foundation, Mantel has helped Lendi Group transform a typically complex and manual process into a simple, automated customer experience.

Ready to get started? We’re ready to listen

Whether you have a specific challenge in mind or are looking to explore the possibilities of technology for your business, our team of experts are here to help.

Please provide your details in the form, and we’ll be in touch to discuss how we can achieve great things together.